2023 Cattle Market Outlook

By Bernt Nelson, Economist, American Farm Bureau

2022 was filled with mountains for U.S. cattle producers to climb. From high feed costs to the third consecutive year of drought, there was no shortage of complex obstacles, many with effects that will carry through well beyond 2023. This Market Intel is a deep dive into the 2023 cattle outlook, and what producers can do to position themselves for what lies ahead.

Inventory

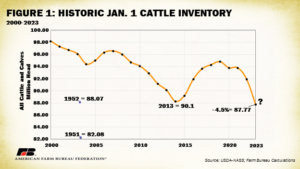

All eyes will be on USDA’s semi-annual cattle inventory report, set for release on Jan. 31. This inventory of cattle and calves in the United States will set the tone for 2023. Many industry experts are forecasting the inventory to be 4-5% below 2022, which was 2% less than the Jan. 1, 2021, inventory. If the report estimates are 3.9% or more below Jan. 1, 2021, the inventory of all cattle and calves in the Unites States would be the lowest since 2013. If the inventory comes in near 5% below 2021, the inventory would be the lowest since we approached 82.08 million in 1951. The last time the Jan. 1 cattle inventory declined by 3% or more was in 1987.

The most recent Cattle on Feed (COF) report estimates that all cattle and calves on feed in U.S. feedlots with capacity of 1,000 head or more were 11.7 million on Dec. 1, 2022. This is 3% below 2021. Placements of cattle into feedlots in November were 1.93 million head, down 2% from the same time in 2021. Marketings of fed cattle in November 2022 totaled 1.89 million head, 1% above the same time last year. This is a record high for November marketings since the survey began in 1996 and comes after a record low for cattle placed into feedlots in October. Marketings of fed cattle outpaced placements of cattle on feed for much of 2022. This is an indicator that farmers are culling cattle and reducing herd size. This was mostly due to farmers facing higher feed costs, and extreme drought conditions, especially in the West and Southern Plains. The next COF report will be released on Jan. 20, ahead of the semi-annual inventory report mentioned earlier.

Production

Beef production for November 2022 was 2.42 million pounds, 2% higher than the same time in 2021. Accumulated production was estimated to be 26.07 billion pounds, 2% higher than 2021, which was a record year for beef production. Production has been aggressive through much of 2022 with packers taking advantage of profitable margins that may not be as easy to come by in 2023. Supplies of cattle will be tighter in the upcoming year, which may force packers to pay more to secure cattle and meet demand. If inventory drops between 4% and 5%, the U.S. will be looking at a 400,000-500,000 metric ton decrease in production in 2023 and will provide price support.

Dressed and live weights were also up for much of 2022, with the average live weight for November coming in at 1,384 pounds. This is up 2 pounds from this time last year. USDA’s Economic Research Service (ERS) raised estimates for fourth quarter beef production by 70 million pounds, to 28.4 billion pounds, due to higher expected cattle slaughter and heavier carcass weights. The combination of increased cattle slaughter and higher average dressed weights should make 2022 a record year for production. ERS estimates 2023 production to slow year-over-year, dropping 7% to 26.4 billion pounds. This is largely due to the expectations for a smaller cattle inventory for the upcoming year.

Weather

For the third consecutive year, drought has plagued much of the U.S. in 2022. The West and Southern Plains experienced some of the worst drought conditions in recent history. This has taken a toll on pasture and rangeland conditions in regions of the country with the highest concentrations of cattle. On Oct. 30, 2022, 64% of the cattle in the U.S. were in regions where more than 40% of pasture and rangeland conditions were rated as poor to very poor. These conditions were among the top reasons we saw contraction in the cattle industry in 2022.

To begin with, the Southern winter wheat crop was damaged because of the drought. Then temperatures dropped during the last week of December before there was adequate snowfall to protect crops from the cold. Winter kill of the winter wheat crop would be another incentive for famers to market cattle and continue contraction of the cattle industry into the spring.

The good news is there have been signs that La Nina has started to weaken. The National Oceanic and Atmospheric Administration’s National Climate Prediction Center updates the Nina status on the second Thursday of every month. According to the most recent summary, La Nina is still present. However, there is an equal chance that ENSO-neutral (El Nino Southern Oscillation – Neutral) status will develop between January and March, and a 71% chance of an ENSO-neutral event occurring in February through April 2023. An ENSO-neutral event is one where neither El Nino or La Nina are present. The ENSO-neutral event is one of the most important climate phenomena because it can change circulation patterns of the global atmosphere. What this means in plain language is that chances are pretty good for breaking the La Nina trend that has caused the drought.

Prices

For the week ending Dec. 6, the U.S. Drought Monitor reported 78% of the United States was experiencing some level of drought. While winter weather has provided some much-needed moisture since the beginning of December, much of the U.S. remains under threat of drought conditions for 2023. The winter weather has given packers some trouble securing cattle, causing a drop in cattle slaughter last week and a jump in beef prices.

Cash asking prices in the Southern Plains have been holding at $158/cwt for fed cattle. So far packers have not been willing to pay that, but the declining cattle marketings reported by COF will force them to eventually pay some higher prices as supplies continue to tighten. In Midwestern states such as Iowa and Nebraska, prices been as high as $160/cwt for fed cattle with the greatest volume of trade occurring near $158/cwt. Prices have been much higher for replacement heifers with desirable genetics, especially in the Midwest. The 5-market weekly regional weighted average fed steer price for the week ending Dec. 4 was $156.42/cwt, the highest price since May 31, 2015, when the average price was $155.59/cwt.

Outside markets such as corn and stock markets are playing a major role in futures price volatility in live and feeder cattle. When stock markets move upward on the day, this is supportive of upward movement in livestock futures because it means consumers have more money to spend. Corn futures are reflective of a primary feed source for livestock. When the price of corn drops, it is supportive of livestock futures. On the other hand, when corn futures increase, it puts pressure on livestock futures.

Feeder cattle are changing the market situation. Recently, feeders and live cattle have really broken out to the upside in the futures markets. Recall placements in the most recent COF report were down 3% year over year. The tighter supply is first felt in feeder cattle contracts. The market is becoming current. This means that the fundamental events are changing futures prices. The January feeder cattle contract is currently trading at $185.22 with the deferred (months outside the nearest contract month) months being much stronger. This really puts things in perspective when the deferred contracts are analyzed. May feeder cattle were trading at $191.86 on Jan. 4, which indicates the expected supply/demand effects later in the year. Live cattle have moved higher as well but not at the same rate as feeders. Lower numbers of placements of cattle on feed are being built into feeder cattle contracts. Live cattle are still available in good numbers from a time when placements were still strong, so the live cattle futures contracts aren’t moving higher as fast.

The choice/select spread (the price difference between choice grade and select grade beef) narrowed a bit after getting quite wide during the holidays. When the spread is particularly wide, it can be an indicator of consumer willingness to pay a premium price for higher grade beef (choice grade). Choice beef was up $9.12 for week ending Dec. 23, 2022. Beef prices continued to jump during the first week of January due to weather issues, with choice up $4.97 at $286.95/cwt and select up $3.70 at $254.63/cwt on Jan. 3. Positive packer margins will spark aggressive buying because packers will want to take full advantage of profitability when it occurs. Packers will be facing periods of negative margins in 2023. The growing spread between choice and select beef combined with record production are an indicator that demand for beef is very strong. If it holds, strong demand with tighter cattle supplies should keep a very positive environment for cattle producers in 2023.

Production Costs

One obstacle to profitability in 2023 will be the cost of production. Net farm income for farmers reached record levels driven by record percent increases in cash receipts across many sectors of agriculture. However, there were other records set as well. Production expenses were also estimated up $70 billion, or 19%, to a record $442 billion in 2022. Costs for feed, fertilizer, chemicals and fuel to maintain pastures are expected to stay elevated in 2023.

Drought has further exacerbated production costs, driving up prices for hay and feed, especially in regions particularly hard hit. Corn prices have come down since their highs in May and June. At that time corn prices approached $7.50 for fall delivery while soybeans were near $15.50 in many production regions of the country. The futures price for the March contract was $6.52, while the December 2023 contract was $5.91. While feed prices have come down from their highs, in most cases these prices are still nearly double what they were just a few years ago.

The cost of debt is another concern for farmers. Farming in general requires a great deal of working capital to continue operating. Interest rates for operating loans will be double or even triple what they were just a couple years ago. This is largely due to the series of interest rate hikes by the Federal Reserve to combat inflation. Inflation has many negative effects including dropping land values, which were recently at record levels.

Consumer Demand

With beef prices expected to go up in 2023, what about consumer demand? Stock market variability and the threat of a recession are on the minds of many and would affect the amount of money in the pockets of U.S. consumers. Households will likely consume as much beef as they can afford. Government programs for nutrition benefits are also supportive of beef demand. The question is, how high will beef prices have to go before consumers start looking for substitutes such as pork and poultry? Retail prices for pork and poultry remain elevated as supplies are tight and avian influenza is continuing to cause problems.

Retail beef prices have been elevated over the last couple of years, reaching as high as $7.55 per pound in October 2021 due to supply chain issues. Since then, beef prices have remained elevated with the average retail price at $7.37 per pound on Nov. 22, 2022. Demand has the potential to drop off if prices move higher but so far it has remained resilient.

Total red meat in cold storage decreased 4%, from 9.75 billion pounds to 9.42 billion pounds in the month of November, but it is up 10% compared to the same time in 2021. Beef in freezers on Nov. 30 was 521.87 million pounds, rising 2% and up 6% from 490.41 million pounds last year. A drop in total red meat in cold storage is typical in the month of November, with an average decline of about 3% ahead of the holiday season. These strong levels of meat in cold storage should help keep retail prices tempered for a while. This is good for producers who rely on keeping consumer demand strong.

Global Market/Trade

With the U.S. looking at reduced production and continued demand, the question then becomes who can satisfy this appetite? Beef importers will be looking to benefit from the decline in production but where will the product come from? Canada and Mexico are historically the top two suppliers in the U.S. market. However, Canada is currently in the contraction phase of their cattle cycle as well. Australia is beginning the expansion phase of their cycle, which will limit beef available for export. South America has the potential to satisfy some of the demand gap. USDA has recently moved to allow trim to be imported into the U.S. from Paraguay under certain conditions. Brazil has enough beef to export but lacks sufficient infrastructure to move beef product efficiently.

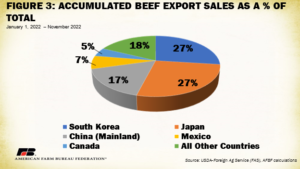

On the export side of things, accumulated U.S. beef exports through November 2022 were just under 1.087 million metric tons, about 4.5% ahead of the same time last year. The top buyers of U.S. beef so far in 2022 in order are South Korea, Japan, China, Mexico and Canada. These five countries are responsible for 82% of all U.S. beef export sales. South Korea, Japan and China alone are responsible for 70% of all export sales.

China has been in the spotlight lately. 2022 is forecast to be a record year for U.S. red meat exports with China buying huge amounts beef. China has begun loosening COVID restrictions, resulting in growing cases of the virus. Last year analysts were expecting loosened COVID restrictions to stimulate demand. On the contrary, when restrictions let up, COVID cases skyrocketed, keeping consumer demand from rising. Beef prices in China have remained strong despite a weakening economy. However, beef prices are also nearly twice that of pork, which is a substitute. This may limit the ability of beef prices to continue their climb in China, which should keep demand strong.

The beef outlook for 2023 is very positive. Cash prices have gone up and still have room for more. A decreasing cattle supply resulting from contraction in the cattle industry should combine with adequate demand to provide support for prices throughout the year. Tighter supplies are showing up through smaller placements of cattle on feed. Lower placements have driven feeder cattle futures higher with live cattle trailing. The deferred months are higher than the nearby and are accounting for the tighter supply and demand. There will be many factors that have the potential to offset higher prices. Farmers will be up against weather, high input costs, inflation and potentially a recession that would leave consumers with less money to buy beef. The good news is demand for beef is very strong in domestic and global markets after what was likely a record year for beef production. Cattle producers will be looking for relief from drought so damaged pasture and rangeland can begin to recover before contraction in the cattle business can come to an end.